#Islam

The 401(k) Zakat Shelter

Published

One of the primary objectives of Islam is the development, preservation, and equitable distribution of wealth in society, and Zakat is the main vehicle for social and economic justice. Charitable giving is considered a proof of faith and withholding charity considered as a serious offense. Thus, when Abu Bakr

Last Ramadan we wrote about the problem of non-profits abusing Zakat. Even more potentially damaging is when people don’t properly pay their Zakat at all. Poorly reasoned opinions on Zakat can lead to hundreds of millions of dollars that are not going to those in need. There are many topics related to Zakat that need clarification, but we will focus on one particular issue, the 401(k). The 401(k) is how Americans tend to hold their wealth. The average 401(k) has roughly $100,000.00 while a typical savings account has less than $1,000.

While there are several legal opinions on the 401(k), it is relatively common for Muslims to be told the 401(k) is exempt, at least until the age of 59 ½. The rationale is that individuals do not have full ownership of the 401(k) as it cannot be withdrawn until the age of 59 1/2 because it is subject to taxation and an “early withdrawal” penalty, which somehow makes the asset illiquid. This view creates a massive Zakat shelter that perpetuates inequity and treats people with similar assets differently for seemingly no good reason.

Keep supporting MuslimMatters for the sake of Allah

Alhamdulillah, we're at over 850 supporters. Help us get to 900 supporters this month. All it takes is a small gift from a reader like you to keep us going, for just $2 / month.

The Prophet (SAW) has taught us the best of deeds are those that done consistently, even if they are small. Click here to support MuslimMatters with a monthly donation of $2 per month. Set it and collect blessings from Allah (swt) for the khayr you're supporting without thinking about it.

Let’s illustrate why with the following examples:

Musa has $2,000,000 in gold stock (this is an exchange-traded fund that owns gold), a home worth $700,000, and $20,000 in cash savings. He wants to pay Zakat, so he consults a Shaykh about his situation. The Shaykh tells him he needs to pay Zakat on $2,020,000, or $50,500 (2.5% of $2,020,000). The Shaykh explains that one’s home is exempt.

Musa’s twin brother, Haroon, also has $2,000,000 in gold stock, an identical home next door worth $700,000, and $20,000 in cash savings. He asks the same Shaykh how much he should pay in Zakat. The Shaykh tells him his home is exempt and he does not need to pay any Zakat on his gold stock. Therefore, he only needs to pay Zakat on the $20,000, which would mean he pays $500 (2.5% of 20,000).

Why the difference? Haroon’s gold stock is in a self-directed 401(k), while Musa’s gold stock is in a regular brokerage account. Haroon’s 401(k) is subject to ordinary income taxes upon withdrawal, in addition to a 10% early withdrawal penalty. However, Musa can sell his gold and be subject to a 28% maximum federal tax rate on the capital gain of the stock. Both Musa and Haroon voluntarily choose how they would own these assets.

Both are subject to taxation upon withdrawal. However, only Haroon is subject to the 10% penalty and ordinary income taxes for all the gold stock he owns. So, for Shuyukh who take the view that the 401(k) is exempt from Zakat for those under 59 ½, Haroon should not have to pay anything on the gold stock.

Same Asset, Different Wrapper

To show why Musa and Haroon should not be treated differently, let’s go over some basics of zakat, though this short article cannot be a comprehensive treatment of the subject:

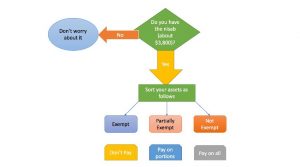

A prerequisite of paying Zakat is possessing the nisab (threshold of possessing surplus wealth) and the passage of the hawl (lunar year). So, if you don’t have enough money over the duration of the lunar year, you don’t pay zakat. You don’t pay zakat on exempt assets, you partially pay on business assets, and you pay the full 2.5% on assets that are fully “zakatable.” Note though other rates apply for agriculture and livestock.

Retirement plans like 401(k)s are not assets in and of themselves, capable of being sorted in the flow chart above. They are “wrappers” for almost any asset providing tax treatment that is different from assets in other “wrappers.” The tax treatment can be considered either better or worse depending on your perspective. Roth IRAs and Roth 401(k)s come from post-tax dollars and are treated differently. However, Microsoft common stock owned in a retirement 401(k) account and Microsoft common stock in other types of accounts are the same, you get the same rights of ownership, such as a dividend (if it is paid) and voting rights.

Voluntary Financial Choices and Landing the Right Job

When you open a 401(k), you are voluntarily participating in an employee benefits program by taking pre-tax dollars from your paycheck and depositing it into an investment account. This money can be invested in your company’s stock, a menu of mutual funds, or perhaps a brokerage option where you can invest in almost anything available for sale in an online brokerage. There are other wrappers for the same assets, such as irrevocable trusts, non-qualified plans, captive insurance companies, limited partnerships, LLCs and other vehicles. A 401(k), as well as other Employment Retirement Income Security Act (ERISA) Qualified Plans also offer asset protection benefits to those who have them. Additionally, your employer may match your contributions up to a certain percentage, essentially giving you free money as a reward for saving.

Let’s take the case of Aisha and her twin sister, Fatima. Aisha works at a corporation that offers her a 401(k) that matches at the rate of 5% and her annual income is $150,000. If she invested $7,500 of her money, her employer would add $7,500 as well (5% of 150,000). Aisha would have $15,000 in her 401(k) account after one year.

Aisha’s twin sister Fatima works at another company that does not offer her a 401(k), and she has an annual salary of $50,000. She saved $10,000 of her money that year. While they both have savings and assuming a lunar year has passed, Aisha was fortunate to deposit pre-tax income into her retirement account, and her employer matched her contribution. Fatima had to save her post-tax money without any help from her employer.

A Zakat rule exempting 401(k) assets while imposing Zakat on other savings penalizes Fatima for not landing a job at a company that offers a 401(k) with matching as part of its benefits package. Such inequity seems arbitrary and unjust on its face.

Does a 10% penalty make something “illiquid”?

The claim that something is illiquid or inaccessible because it is subject to ordinary income taxes and a 10% penalty also appears to be a weak reason to exempt assets from Zakat on another count: The term “subject to taxation” does not mean it will be taxed. The 401(k) is more complicated than merely a 10% penalty (which generally applies to similar plans), since there may be the ability to borrow from an account you do not close down. Though this should normally not be necessary.

To illustrate, let’s add some facts to our first example. Say Haroon, who has his gold stock in a 401(k), is about to have losses for the year in a failed business. He does not know this will happen when he pays Zakat. His losses would wash out any penalties and taxes he may pay on his 401(k) if he decides to withdraw it. Musa will have a great year and would pay the full 28% capital gains tax on his gold if he sold it. Gold has a higher capital gains rate than other kinds of assets. So in this example if we follow the 401(k) is exempt from Zakat view, Haroon’s wealth is regarded as “illiquid” because he is subject to taxes he legally does not pay. While Musa has to pay taxes, but his gold is (properly) considered fully “zakatable” because his assets are somehow considered more liquid. Moreover, when the time comes to calculate Zakat, there is a realistic possibility that neither Musa nor Haroon will have any idea what tax bracket they will fall in, if they will make or lose money, what specific exemptions they will have and so forth. They may have some idea, but they don’t truly know the future.

The practice of making sweeping judgments on qualified plans based on their potential tax treatment serves to create a contrived Zakat shelter. Taxation, as taxpayers know, is subject to variables such as income, brackets, exemptions, exceptions, deductions, and credits. Furthermore, a flood of regulations, memoranda, and court opinions add to or modify tax rules regularly. The very wealthy, because tax laws tend to be written to favor them, often pay little to no taxes in comparison to their resources while the middle class often pay far more.

Does a 10% Penalty mean your money is not liquid?

As to the 10% early withdrawal penalty that evidently makes the asset inaccessible, according to some Shuyukh, the government is far more flexible than many realize. If you know you are going to withdraw a similar amount every year, for example, you can make the withdrawal without any penalty according to the tax code.

Does this mean the answer is clear and that you should treat the entire 401(k) plan the same as cash? Well, not really as there may be more to it. For example, some assets in a 401(k) may not be “vested,” which is to say not yet owned, and therefore exempt from Zakat. In the case of the 401(k), we share the opinion of reputable scholars, that all vested assets in a 401(k) are “zakatable”, regardless of which “wrapper” the asset is in (e.g., through a personal business, corporation, etc.). We leave aside for now the issue of calculating Zakat for the underlying assets inside a 401(k), particularly common stocks. This can be addressed separately.

If we are not careful in getting our zakat calculations correct, we will end up excluding what may be billions of dollars of wealth American Muslims possess from Zakat. The sad fact is, the current crop of articles, seminars, and overly-simplistic zakat calculators do not do justice to this pillar of Islam.

In General, knowledge of Zakat in the United States is woefully underdeveloped, providing opportunities for the proliferation of views exempting payment for dubious reasons. Islamic Scholars would serve the Muslim community best by developing appropriate uniform standards on payment of Zakat that both understands the realities of how Americans hold wealth as well as the rights of those entitled to Zakat.

Osman Umarji was born and raised in Southern California. After spending years working as an engineer, he left his career to pursue an Islamic education at Al-Azhar University, specializing in Islamic law and legal theory. He previously served as an Imam and has spent years studying Zakah and has given numerous seminars on the topic. He is currently pursuing a PhD at UC Irvine in Educational Psychology, while also serving the community as an educational consultant

Keep supporting MuslimMatters for the sake of Allah

Alhamdulillah, we're at over 850 supporters. Help us get to 900 supporters this month. All it takes is a small gift from a reader like you to keep us going, for just $2 / month.

The Prophet (SAW) has taught us the best of deeds are those that done consistently, even if they are small. Click here to support MuslimMatters with a monthly donation of $2 per month. Set it and collect blessings from Allah (swt) for the khayr you're supporting without thinking about it.

Ahmed Shaikh is a Southern California Attorney. He writes about inheritance, nonprofits and other legal issues affecting Muslims in the United States. He is the co-author of "Estate Planning for the Muslim Client," published by the American Bar Association. His Islamic Inheritance website is www.islamicinheritance.com

Far Away [Part 3] – Wounded

Darul Qasim College Given License To Grant Master’s Degrees

MM Wrapped – Our Readers’ Choice Most Popular Articles From 2025

Can You Fatwa Shop with AI? The Answer Might Surprise You

Quebec Introduces Bill To Ban Prayer Rooms On College Campuses

Op-Ed – When Islamophobes Try To Intimidate Us, They Underestimate Our Resolve: A Call to Stand With America’s Muslim Students

Ahmed Al-Ahmed And The Meaning Of Courage

Restoring Balance In An Individualized Society: The Islamic Perspective on Parent-Child Relationships

AI And The Dajjal Consciousness: Why We Need To Value Authentic Islamic Knowledge In An Age Of Convincing Deception

Moonshot [Part 32] – FINAL CHAPTER: A Man On A Mission

[Dhul Hijjah Series] Calling Upon the Divine: The Art of Du’a (Part 1)

IOK Ramadan 2025: Four Steps | Sh Zaid Khan

IOK Ramadan 2025: Do Your Best | Sh Zaid Khan

IOK Ramadan 2025: Giving Preference to Others | Sh Zaid Khan

IOK Ramadan 2025: Which Group Are We In? | Sh Zaid Khan

Trending

-

#Life4 weeks ago

Op-Ed – When Islamophobes Try To Intimidate Us, They Underestimate Our Resolve: A Call to Stand With America’s Muslim Students

-

#Current Affairs1 month ago

Who’s Afraid Of Dr. Naledi Pandor? – Zionist Panic and a Visa Revoked

-

#Current Affairs1 month ago

November 29 Is The International Day Of Solidarity With The Palestinian People – What Will You Do?

-

#Society1 month ago

Op-Ed: What Muslims Will Really Be Talking About Over the Halal Turkey This Thanksgiving

abdul razzaq

June 22, 2017 at 2:02 PM

sorry I disagree. lets take your $100,000 in the average 401k. zakat would be $2500. more than the $1000 average people have in savings.

so to pay the zakat of $2500 you would need to take out almost $5k so you could cover ordinary income tax and a 10% penalty.

if anything the real zakat on a 401k 100k should be $100k -40% * 2.5%, leaving someone with $1500 zakat due and still not enough liquid assets to pay.

Ahmed Shaikh

June 22, 2017 at 2:38 PM

Thank you for your comments. 1) It may be that you need to pay $2,500 in Zakat if you invested in gold, but we did not address how Zakat is calculated on all conceivable assets inside a 401(k).

2) The notion that 401(k) funds must be withdrawn in order to pay Zakat is interesting. This assumes there is no, or almost no other income throughout the year (which can be used to pay Zakat), in which case the money should likely be withdrawn free of penalties and income tax.

Teepu

June 26, 2017 at 11:37 AM

TIAA CREF? Where does that fall ?

Fahd A

June 22, 2017 at 6:06 PM

Br. Ahmad raises the critical point: no where in zakat owed calculus seems to be a barrier of liquid or illiquid assets. If a Muslim owns a second home that they don’t use personally, most of us will probably agree this would be zakatable. Then we wouldn’t quibble over the fact that they would have to sell a few bricks or a wall to pay zakat on it :-) I understand Br. Abdul Razzaq’s point, that if Allah blesses you with enough wealth and ability to save into a 401(k), you may find it increasingly hard as years go by to pay the zakat out of your regular income. In hard years, you may have no choice but to liquidate some savings to fulfill your zakat obligation. But illiquidity (vs. sheer control over the asset such as non-vested portions) does not seem to be a valid reason to exclude assets, as this article explains with clear logic.

I am no imam but in my readings on this topic I have seen mentions of deferring zakat on certain kinds of assets and paying the accumulated sum later. Perhaps the authors can elaborate on our options, if any, when we have illiquid zakatable wealth of some sort, due to the inherent nature of the asset (e.g., real estate) combined with income hardship.

Mohamed Soumakieh

July 2, 2017 at 12:26 PM

If you own a second home usually u have plans for it such as selling that house for a profit or you may rent that house and make money which in both cases u will have the mean to pay zakat. So this is different from 401k scenario

K S

June 22, 2017 at 2:21 PM

i agree with the commentor. If an average person who does not have much saved was to pull out 401K money every year their funds would be severely depleted for retirement since pulling out money will increase your taxable income too. You have to be careful and be keen to pay zakat properly

Yousif

June 22, 2017 at 4:30 PM

Correct me if I’m wrong, but what Ahmed is trying to say is you don’t have to pull money out of your 401k to pay Zakah. If you meet the “nisab” as he mentioned then you would calculate the Zakah on the 401K, but actually pull the Zakah out of your other sources of income.

Ahmed Shaikh

June 22, 2017 at 6:12 PM

It would be advisable. Of course, coming up with the money to pay Zakat is not always easy, even if you don’t have a qualified plan.

Yousif

June 22, 2017 at 4:23 PM

Subhan Allah! your last comment nailed it!

“… and overly-simplistic zakat calculators do not do justice to this pillar of Islam.”

Is there a book you would recommend a layman or student of knowledge to read so that they are more familiar with Zakah in its entirety?

Osman Umarji

June 27, 2017 at 4:43 PM

Sheikh al-Qaradawi’s book on Zakat is quite comprehensive and useful. It has been translated.

AU

June 22, 2017 at 5:05 PM

Salam

What happens in countries where you have no control at all of your 401k. Meaning there’s no way you can take out before the age of 60. There’s no option of hardship withdrawal or any exceptions. On top of that, it’s mandated on employers to pay to retirement funds and the individual does not have to pay to get matching (like in US). How should we treat that case?

Osman Umarji

June 22, 2017 at 5:59 PM

In the case you mentioned, there would be no zakat due on that asset because there is no ownership. I doubt it would be classified as a 401(k), as it is specific to US tax code.

Osman Umarji

June 22, 2017 at 6:10 PM

I just want to point out that our opinion is not a new opinion on the topic. This article was not intended to be a full legal analysis of the issue. Many other reputable scholars from various traditions hold the same opinion. See the links below:

http://www.zamzamacademy.com/2010/08/permissibility-of-and-zakat-on-401k-plans-other-securities/

http://seekershub.org/ans-blog/2013/05/21/zakat on-401kretirement-plans/

http://www.calislamic.com/2017/06/17/zakah-401k/

Frank C

June 22, 2017 at 6:51 PM

There are too many assumptions in this article. A company’s contribution is technically “free money”, but you don’t have access to it until the age of 59-1/2. Secondly, the average American is living paycheck to paycheck. What happens when the amount you owe on your 401k is greater than you have in the bank? Do you take out a loan each year to pay zakat on wealth you don’t even have direct access to? This will cause greater debt. The loan you take out will have high interest payments. It doesn’t make any logical sense.

Take this example:

Rashid promises his 18 year old son, Kareem that he will give him $100,000 on his 28th birthday, but if Kareem ever needs money in the mean time, he can borrow from him, but will need to pay it back. Does Kareem pay zakat each year on money he doesn’t have yet or pay it once he receives it? The logical response is to pay it once he receives it. Taking a loan from your 401k is essentially the same thing, except that you also have taxes AND interest payments.

Ahmad

June 23, 2017 at 2:25 AM

This doesn’t make any sense and is not practical at all. As time goes on the 401k continue to increase each year more and more “zakat” is due.

lets assume a 401k will earn 10% year on year. Someone makes 100k, after taxes, 5% contribution to the 401k, medical plan, rental, food, bills, car etc actual cash for saving is $4k. I’ve only factored basic needs shelter, food, transportation (two cars) for a typical North american family etc.

Granted you haven’t spoken about how to pay for it, i’ve assumed 2.5% but how will this person afford to pay, by 25 years the zakat you speak of that would be owned by this is $35k

1 $100,000 $2,500

2 $115,000 $2,875

3 $131,500 $3,288

.

.

.

25 $1,427,460 $35,686

26 $1,575,206 $39,380

27 $1,737,726 $43,443

28 $1,916,499 $47,912

29 $2,113,149 $52,829

30 $2,329,464 $58,237

Omaran

June 23, 2017 at 4:18 AM

Thank you for bringing this important and relevant issue for us Muslims living in the US. There are several fatawa regarding this issue and not all of them exempt 401k money as you seem to suggest. The method of calculation is to subtract the taxes due and the penalties and then pay 2.5% on the balance.

Ali

June 23, 2017 at 10:08 AM

Is it your opinion that the payment of zakat is due immediately? Many of the opinions I’ve heard on this matter is that while zakat may be owed and should be calculated, it need not be distributed until you begin taking distributions from the 401k. This is more rational for a number of reasons mentioned by other commenters, plus it gives clarity to what your income tax rate (and hence liability) will be at the time of withdrawal. Every penny of zakat is eventually paid, just years later.

What is your opinion on this approach?

Osman Umarji

June 27, 2017 at 4:42 PM

Here is my reply to a number of questions raised.

1. To clarify, the opinion given in this post is not new or groundbreaking. Many reputable scholars have said the same years ago. See the following links for the opinions of Dr. Monzer Kahf, Mufti Abdurrahman Mangera, and Imam Mustafa Umar.

http://monzer.kahf.com/fatawa/2000-2002/FATAWA_ZAKAH.pdf

http://seekershub.org/ans-blog/2013/05/21/zakat-on-401kretirement-plans/

http://www.calislamic.com/2017/06/17/zakah-401k/

2. In the case where one ha 401(k) assets that are so large that one cannot pay them annually from cash on hand, here are a few choices one has. I will not comment on what one should do at the moment, perhaps that needs a separate article and analysis.

a. Pay the taxes and penalty on what you need to withdraw in order to pay your Zakat annually.

b. Delay payment temporarily and reduce annual contributions so one has more cash on hand to pay Zakat.

c. Pay at the age of 59 and a half on all the previous years. This is tricky (not necessarily unlawful though) for two reasons. (1) You are essentially telling the poor to wait for decades for your wealth. (2) The number will be extremely high that will not be spiritually easy for many to pay.

d. Pay a portion of your due Zakat with whatever cash you have on hand and pay the rest when possible.

3. According to the fiqh of Zakat, some of the conditions of wealth being “zakatable” are if the money has the possibility of growth and one owns that wealth. The owner of the 401(k) account one is (possibly) making money on the full amount year after year and owns the fully vested amount. For example, if someone has $100,000 in a 401(k) and it grows at an average rate of 8%, they have $108,000 after 1 year. Thus, one is benefiting from the money in its entirety.

Ashraf Gomma ali

June 23, 2017 at 11:26 AM

Sh Salah al Sawi is of the opinion that you the zakatable portion of the 401k or any type of “wrapper” is what you would get if you liquidate today (after taxes and penalties). This would apply generally if the assets were held for trading purposes. If they were held for Income purposes, then only the income would be zakatable. If they were held for long term trading purposes, there are two opinions: one which requires zakat annually and another which requires zakat after selling the assets. I believe the second is more fitting for 401k in case of long term investments. And Allah knows best.

Safiya

June 23, 2017 at 12:11 PM

If this is the ruling, then the same ruling should apply to pensions and social security.

Both pensions of government employees and social security in general for all citizens,has the same type of calculation as 401K.But the investment funds that the money gets allocated to and the contributor is the government.Sheikh,please confirm why pensions and social security is not zakatable before the retirement age.

OQ

June 24, 2017 at 9:20 AM

Does a service oriented business have zakah on its assets like a school on its chairs, computer lab etc?

Justin Ducote

June 24, 2017 at 7:12 PM

Alsalamalaykum dear brothers,

I think there is a typo in the sentence: “Roth IRAs and 401(k) come from post-tax dollars and are treated differently.”

401k monies would come from pre-tax (not post-tax) income, correct ?

Or perhaps it is missing a “that” or “which” somewhere in the sentence ?

justin

Justin Ducote

June 24, 2017 at 9:09 PM

After reading this article and leaving my question, I just learned today about the existence of a “roth 401k” which is derived from post tax earnings, I figure that is likely what the authors meant as in “roth IRAs and roth 401(k)s”

Ahmed Shaikh

June 24, 2017 at 10:01 PM

Yes, this is exactly right. I should have said “Roth IRSs and Roth 401(k)s” and this has been fixed. Thanks for the catch!

Osman Umarji

June 29, 2017 at 12:23 AM

Here is my reply to a number of questions raised.

1. To clarify, the opinion given in this post is not new or groundbreaking. Many reputable scholars have said the same years ago. See the following links for the opinions of Dr. Monzer Kahf, Mufti Abdurrahman Mangera, and Imam Mustafa Umar. You can see there opinions at seekershub or calislamic websites.

2. In the case where one has 401(k) assets that are so large that one cannot pay them annually from cash on hand, here are a few choices one has. I will not comment on what one should do at the moment, perhaps that needs a separate article and analysis.

a. Pay the taxes and penalty on what you need to withdraw in order to pay your Zakat annually.

b. Delay payment temporarily and reduce annual contributions so one has more cash on hand to pay Zakat.

c. Pay at the age of 59 and a half on all the previous years. This is tricky (not necessarily unlawful though) for two reasons. (1) You are essentially telling the poor to wait for decades for your wealth. (2) The number will be extremely high that will not be spiritually easy for many to pay.

d. Pay a portion of your due Zakat with whatever cash you have on hand and pay the rest when possible.

3. According to the fiqh of Zakat, some of the conditions of wealth being “zakatable” are if the money has the possibility of growth and one owns that wealth. The owner of the 401(k) account one is (possibly) making money on the full amount year after year and owns the fully vested amount. For example, if someone has $100,000 in a 401(k) and it grows at an average rate of 8%, they have $108,000 after 1 year. Thus, one is benefiting from the money in its entirety.

Mohamed Soumakieh

July 2, 2017 at 12:14 PM

This is very very difficult subject. I am not convinced with any opinion out there yet!

I think paying zakat on 401k is extremely difficult especially after 10 or 20 years. Which will make Muslims stay away from retirement plans. If they do most people will end up not saving at all as they grow older which is not only bad for them but is equally bad for the Muslim community as there is a lot less wealth to pay zakat on (this point could be a lot more important than the tax shelter idea in terms of amount of zakat lost).

BS

November 23, 2018 at 2:48 AM

This is a very important issue often overlooked by many Muslims. However, the article failed to illustrate the issue with a realistic example. For instance, it could assume simplified case where an employee contributes $10,000 a year and his employer matches $5,000 that vested throughout the year uniformly. So, after 1st year there is $15,000 in the 401k plan. How much will be the due, if we assume the employee’s tax bracket is 30% and there is 10% penalty.

Next, the first year’s contribution grew by 10% next year. So at end of 2nd year the total amount in 401k = $15,000 * 1.1 + $15,000 = $31,500. Out of this $1,500 grew as “capital gain” from the fund’s investment. How much will be the due at end of 2nd year?

Please write a follow-up article to demonstrate such use cases. Without that I don’t know how much useful this article is. Allah knows the best!

Omer Minhas

May 10, 2019 at 3:36 PM

Assalamualikum, I recently came across the following 2 videos from shaykk Yasir Qadhi regarding zakat on 401k, and wondering how the author of this article reconciles them with what he has written.

https://www.youtube.com/watch?v=DuTr6LeoQHI 25:00 to 30:00

https://www.youtube.com/watch?v=wDxfTL5PkHY 16:00 to 19:00

I understand that there is an opinion that for those who do not have sufficient funds on hand to pay the zakat on 401k, can track zakat for each year and then pay it altogether at the time it is distributed on/after age of 59.5. However, what is the guarantee that one will live until that long, in which case wouldn’t it actually be a burden on that person?

Salman Nazir

May 12, 2019 at 5:02 PM

Dear brothers Shaikh and Umarji, in a TIA-CREF account you are not allowed to withdraw at all unless you quit your job or retire. This means you do not have access to that money at all. So what about zakat in that scenario. Is it still applicable?

Ahmed Shaikh

May 19, 2019 at 3:13 AM

There is a question of calculation, which the article does not address. However, plans will often not let you withdraw. But the fact that you can withdraw if you leave your job is not the same as completely unavailable. You may consider calculating what you owe and paying through the year from other sources. Even so, say you had $10,000,000 in gold stocks in your account (you probably don’t). The article goes to point to the absurdity of taking the position that you owe no zakat at all. The article, which is three years old now, is still unsatisfying (to me anyway) and Zakat is no better developed and understood now than it was then.

Usman

May 19, 2019 at 2:50 AM

This article and many like it on 401k accounts treat all assets within 401k to be similar. This is problematic. How can stocks be considered like cash or inventory? Owning a stock means I am a partial owner of a business. So I should only have to pay zakat on the inventory of that business (not on the market value of the stock). If a 401k account is all stocks (such as equity only mutual funds), then if the value of 401k is 100,000$ one can estimate the inventory on average that public companies carry per $ market value and use that to estimate the inventory one is responsible for. It seems illogical to treat ownership of a business in the same category as cash or goods for sale. Just because one can sell ownership of a business, it does not make that ownership equivalent to holding goods for sale. Stocks in 401k are long term investments (not day to day trading). Most people only cash out when they really need the money. When one really needs the money (if one did not have stock ownership) one can also sell books, clothes, car .. anything one owns can be sold in a hardship. Does that make all these things inventory and hence zakatable? All scholars say No. So why is ownership of businesses treated in this way? Also this poses a great dilemma esp in Muslim countries. Let’s say I own $100,000 worth of stock of companies in a Muslim country where all these companies pay zakat on their inventory. If I now have to pay zakat on these shares of these companies, then Zakat is being paid twice using 2 different rules for the same business. Also the value of a company (stock price) reflects current estimate of all future earnings. If one has to pay zakat based on stock price, it is like paying zakat on an estimate of all future earnings of the business. Doing this year on year would mean that business earnings get deducted for zakat numerous times. Imagine that one expects to earn 10,000$ after 10 years. Since this is part of the stock price, one would end up paying zakat on this 10,000$ earnings 10 times before it is even earned by the business. In short, there are many logical challenges in equating ownership of a business to cash or inventory, and hence paying zakat on stocks held for the long term based on stock price does not make sense.

Ahmed Shaikh

May 19, 2019 at 3:07 AM

Thank you for this comment. This article did not suggest what you seem to have gleaned from it. A 401(k) is not an asset class, but a kind of account, a wrapper if you will. It can hold real estate, gold, common stocks, cash and almost any other kind of asset. It is subject to both plan and statutory rules which makes it more challenging. It is like we described, an underdeveloped area which seems absurd given this is a pillar of Islam.

MH

August 27, 2025 at 3:15 AM

Very insightful and complex topics, as 401(k) can hold varieties of asset underneath including real estate, gold, stocks, cash, among others.

There are several issues missing in this article. First, it cannot be correct that $1M in 401(k) == $1M cash on hand. So it must consider the REAL VALUE of $1M. For HCOL states like in CA with high AGI having marginal tax rate of 50%+ (Federal + CA + Social security), REAL VALUE of $1M in 401(k) == ~$400K cash on hand.

A second conflict comes from why Zakat is exempt on rental property but 401(k) holding real estate properties under some REIT. For example, a $1M rental property in Bay Area may bring as low as $18K net income (after property tax, insurance, HOA etc. deductions), and the zakat ruling exempts $1M worth home, and only takes the net income of $18K to calculate the zakat.

However, if one holds $1M worth of real estate under 401(k), this article suggests zakat to be paid on $1M valuation. Even if we consider the marginal tax and penalty deductions, the net valuation of $1M worth of real estate under 401(k) would be a lot lot higher than meager $18K rental net income as suggested in above scenario.

MH

August 27, 2025 at 3:36 AM

Besides the above point, as someone else pointed above with capital growth in 401(k), what is the TRUE VALUE of $2M in most commonly adopted pre-tax 401(k), where one made say $X contributions (including employers match), and $Y is capital growth.

When this $2M to be withdrawn, following tax must be imposed.

* Early withdrawal penalty on $2M: 10%

* Income tax on $X (up to 51%+)

– marginal federal tax rate of 37%

– marginal state tax (12.3% in CA)

– medicare tax of 1.45% + 0.9% = 2.35%

* Capital gain (both LT and ST) tax on $Y, where $Y= $2M – $X

– ST capital gains for gains from last year contribution (up to 49%+)

+ federal tax rate 37%

+ state tax (up to 12.3% in CA)

– LT capital gains from all prior years contributions (up to 36%+)

+ federal tax rate 23.8%

+ state tax (up to 12.3% in CA)

Dey ex-Machina

December 28, 2025 at 5:51 PM

You need tasaruff, meaning, effective control and the practical ability to dispose of the wealth, for it to be liable for zakat. This means you can use it, transfer it, sell it, gift it, lease it, pledge it, consume it, or otherwise deal with it in a way recognized by law and custom. An early withdrawal is not a standard practice, it is in spirit, a breach of contract and it is associated with a contractual penalty, for that breach.

“If we are not careful in getting our zakat calculations correct, we will end up excluding what may be billions of dollars of wealth American Muslims possess from Zakat. The sad fact is, the current crop of articles, seminars, and overly-simplistic zakat calculators do not do justice to this pillar of Islam.” – this is actually wrong. If muslims started withdrawing from their 401k to pay zakat en masse, the result would be less money for the poor, jeopardize the retirement savings of the payer and enrich the government. This is because of the penalties, and extra taxes paid upon non standard withdrawal would make the operation mostly beneficial to the government an damaging to the muslim person.