Career and Money

230 Imams Got Together at the AMJA Conference to Discuss Islamic Home Financing in America. Here’s What You Missed.

Published

If you opened this article to find out which Islamic mortgage companies are halal and which ones are haram, then save yourself the time and close this page now because you won’t get it here.

This past weekend I was fortunate enough to attend the annual AMJA [Assembly of Muslim Jurists of America] conference. They cover a different topic each year and this time it happened to be home financing. This is a topic I’ve had a personal interest in for some time, regrettably caused a stir over a while ago, and have a vested interest in now particularly because of the DebtFreeMuslims project I am involved with.

How I Snuck Past Security to Get In

The first struggle was figuring out if I could even attend. It is an Imams conference after all. But it was taking place in my city, and I really wanted to hear the discussions on the topic. I decided to go ahead and register.

Keep supporting MuslimMatters for the sake of Allah

Alhamdulillah, we're at over 850 supporters. Help us get to 900 supporters this month. All it takes is a small gift from a reader like you to keep us going, for just $2 / month.

The Prophet (SAW) has taught us the best of deeds are those that done consistently, even if they are small. Click here to support MuslimMatters with a monthly donation of $2 per month. Set it and collect blessings from Allah (swt) for the khayr you're supporting without thinking about it.

https://twitter.com/ibnabeeomar/status/427233642843107328

You can see that the conference does have room for guys like me, although its quite a long and depressing scroll down to “Mr.” (as someone eloquently pointed out to me on Twitter).

https://twitter.com/ibnabeeomar/status/427234213369106432

It also just so happens that this good looking (sorry he’s married now) guy, who happens to be the CEO of MuslimMatters, was helping organize the conference. I had him verify it was ok to sign up.

Turns out the registration wasn’t that strict – a few locals usually end up attending depending on the topic. In general though, it’s for imams and the conference content is tailored accordingly to that audience.

Overview: Setting the Stage for a Real Discussion on Islamic Home Finance

Upon registration we received a comprehensive notebook with research papers examining the contracts of various Islamic mortgage companies. Various scholars at AMJA did their best to go through the contracts. They made observations on what they felt were pertinent to the shariah compliance of these contracts along with some suggested changes. Before you ask – no, I cannot share these notes [more on that in a minute].

The way the conference was set up was that a scholar from AMJA would make a presentation about the contract, and then the company (we heard from about 6 different companies this weekend) would then give a presentation. These were done by some combination of their executive/administrative members and scholars on their shari’ah boards.

The encouraging part of this for me was that it was the first time I heard a lot of these issues being discussed openly and in detail. It also seemed like the first time some of these companies were speaking openly with an organization such as AMJA. I have to commend the scholars for showing by example the proper adab for these types of situations. I was impressed that the scholars were able to openly speak about the issues without anyone taking it personally.

The main shortcoming was that it seems proper notification was not given to the companies about how the discussion would take place. This became readily apparent as the presentations went on. The research from AMJA wasn’t made available to the companies with enough notice to get answers from their shari’ah boards. Unfortunately that made it feel a bit like a congressional hearing on steroid use in baseball, but nonetheless it was a good step.

Ideally, the research from AMJA should have been given to the companies a couple of months in advance. This would have allowed them to take suggested changes into consideration and then come back to a conference like this and explain what changes they made, and if they couldn’t implement something then why.

In addition to the banks, we also heard from a small housing co-op. It wasn’t critiqued in detail, but some pointed out that while it may be seemingly more shari’ah compliant in terms of the actual contract, it also faces difficulty in that it carries higher risks, long wait times, and is not scalable to actually be a national solution [the second they commercialize to that scale, they would be subject to the same regulatory requirements that throw a wrench in the other finance contracts].

The majority of discussion was at a very academic level, and analyzing very specific issues in some of the contracts and the mechanisms by which it was achieved. We learned the basics of the various Islamic companies, their core business, the types of financing they offer, and examining those specific contracts in light of shari’ah concerns and suggestions to fix objectionable parts of the contract.

As for the outcome of the conference, the finance companies’ shari’ah boards will look at the points raised at AMJA. They’ll go back and forth with each other for a bit and then present the final research to a larger assembly of global scholars to try and get final rulings. This process will take a few months. No final rulings were issued on any company at the conference (that’s why I told you to stop reading this post earlier if that’s what you were looking for).

The Big Picture

Islamic finance has to satisfy:

- Shari’ah Constraints – so its halal.

- Regulatory and Legal Requirements – so the government doesn’t shut you down.

- Investors – There has to be a viable business so people can make money [interest is haram, profit is not].

- Customers – Someone actually has to buy this thing you’re selling.

What this lays out for us is the big picture. A shari’ah compliant contract cannot exist in a vacuum. Otherwise, as common sense would dictate, every single one of these companies would just have a 100% shari’ah compliant contract that had no objections and just use that. But because we live in a world with specific realities, that is not the case.

Traditionally, the borrower/lender relationship in Islam is one of charity. Now it’s the predominant mode of business. No matter what solution we try to provide, we have to understand that solution is being implemented within a global system that is based on interest. This presents a number of complex realities that must be dealt with.

What may look like “repackaging existing mortgage contracts” on the outside is actually years and millions of dollars of research trying to figure out how to jump through hoops to put a shari’ah compliant program in place without crossing the boundaries set by their advisory boards and things like the AAOIFI standards.

We don’t see the research process that went into how the contracts were developed. Often times it consists of taking a shari’ah contract, trying to implement it then running into a legal or regulatory roadblock. Then they adjust the contract, within bounds of shari’ah to bypass that roadblock and move on til they hit the next one, and so on. This is further complicated by the fact that many of the government regulations are themselves nonsensical. Add to that how different contracts have implications in terms of taxes and so on and it gets complicated quickly. Some of the contracts are 200+ pages in length, and what we often see is a summation in English that doesn’t truly represent what went into the decision making process.

A lot of us sit back and assume there are simplistic solutions to these problems. Foreign investors are hard to find because they get better rates of return in other emerging markets. One of the reasons is due to government subsidies to keep the prices low (another complication to the whole process).

One thing that validates a lot of what is written above is the fact that many of the Islamic finance products are not available in certain states in the US. The reason is because complying with the regulations in those specific states would force them to bend the contracts beyond what their advisory boards would consider to be acceptable in regards to the Shari’ah. This costs them millions of dollars in business.

One question that comes up is to say that we should force the system to change. Here’s the truth. As far as Freddie and Fannie are concerned, the entirety of the Islamic finance industry here is barely a rounding error on their 2 trillion dollar+ balance sheet (as David Loundy from Devon so eloquently put it). The other sad reality is most Muslims simply do not care. How many Muslims would willingly take a mortgage where they had to give up a share of the profits when selling their house? One company said they tried it in a limited format and no one would sign up for it. Less than 10% of the Muslim audience is concerned with Islamic financing, and of that 10, only 1% are truly concerned for the shari’ah. The other 9 will simply go with whoever has the cheapest monthly payment. Some might say this is pinning ourselves in a corner and a position of weakness, but it’s reflective of reality.

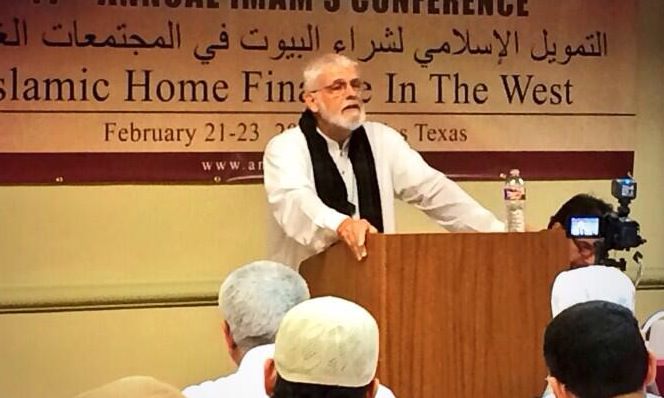

Shaykh Jamaal Zarabozo and Shaykh Yusuf Talal Delorenzo discussing the contract of Guidance Financial. Imam Sphendim Nadzaku moderating.

By the same token, even with the big picture realities we deal with, the details cannot be overlooked either. Even though a lot of details and technicalities were discussed – those details are still extremely important. In many cases they can change a contract from being prohibited to permissible and vice versa.

The details help determine whether some of the liberties being taken are truly to fit the system, or if they’re a back door to interest. Are the contracts providing an illegitimate loophole for some kind of evil aim, or utilizing legitimate flexibility to fulfill a noble aim? We are truly in need of work-arounds to achieve the aims of the shari’ah and make things easy for Muslims. The details help make sure that the overarching wisdom of the technicalities within the shari’ah are complied with and not completely stripped of meaning. When this happens, people begin mocking the shari’ah altogether.

Going forward, I think it’s important to understand the roles at stake and how they can provide good checks and balances. I think AMJA serves an essential role in that they can provide outside scholarly insight. This is critical in that it’s a shari’ah advocacy and can do it’s best to provide an outside check on contracts to make sure Islamic principles aren’t being compromised. The everyday Muslim consumer also plays a role in that they can demand more transparency from these organizations. I personally felt a lot of debate that’s taken place over the past few years could have easily been avoided with some level of openness. But until we demand it, there is no incentive for anyone to open up. These components together can help push us toward a viable Islamic finance model in the US.

Litmus Test for Selecting an Islamic Finance Company

This is vital for most of us. We forget sometimes that we aren’t experts in Shari’ah, regulatory requirements, economics, or finance. This means at some point we must put our trust in established scholarship and make a decision. How do we know what company to pick, especially if we’re unable to navigate the murky waters of finance and regulations?

1. Is the Islamic finance company adhering to the AAOIFI standards?

Scholars from both AMJA and the finance company advisory boards advocate operating within the AAOIFI framework (one of the few points of agreement :)). This is the auditing organization for Islamic finance institutions. They all get their certifications from AAOIFI, which is headquartered in Bahrain.

2. Do they have a qualified independent shari’ah advisory board? Has this board actually issued a fatwa? And do they interface regularly with the institution?

You can look up the scholars on their board and see if they are trustworthy and qualified. Not just any scholar can sit on these boards, but they need to have expertise in the fiqh of finance and also an understanding of modern finance.

Unfortunately some companies are independently running without actual scholarly input. An example of this is a company that posts a fatwa thats similar to the model they use, but they don’t have an actual shari’ah advisory board.

I feel compelled to mention that only one company that presented at AMJA had no scholarly board. In fact, they seemed to take pride in that fact and bragged that they “don’t buy scholars.” The other companies supplied AMJA with updated contracts and information, but this company would not do so unless AMJA signed a non-disclosure agreement that essentially said they would sue AMJA if they said anything bad about them. When given a chance to present their side of their finance model at AMJA, they simply spoke in broad cliches and made some thinly veiled personal attacks at the AMJA scholars which was truly disheartening.

I mention this story to illustrate a couple of things. First, it is true, there definitely are companies that are operating outside relatively agreed upon frameworks. Because they’ve completely disregarded scholarly oversight, they make it difficult for anyone to take them seriously, but worse – they entrench the stereotype of just playing with the shari’ah and throwing together a conventional mortgage with a new package. Second, I mention it because it actually gives much more credibility to the other organizations. Simply showing a willingness to be transparent with an outside body like AMJA and discuss these issues in detail in such a venue gave me an immense amount of respect and confidence in their efforts.

Personal Reflections

Since the conference ended, I have been inundated with messages on Twitter, Facebook, email, and even phone conversations (that’s the sign of it getting serious). I’ll start by sharing some of the sentiments others have expressed to me and offer some closing thoughts at the end.

All Islamic Finance is a sham. You can put lipstick on a pig, but it’s still a pig. We don’t need Islamic finance anyway.

Being cynical is definitely the easy route. It takes more work to be able to give someone the benefit of the doubt. I’ve struggled with this myself, but finally hearing things in the open had a large effect on me. There are sincere people who have made huge sacrifices to try and figure out a way to bring halal alternatives to us so that ultimately we can achieve our goals in a halal manner. It’s extremely disingenuous to throw the whole thing out dismissively.

When you hear from scholars who have dedicated themselves to this field longer than most of us have been alive – you develop a huge appreciation for the work they’ve put in, and how foolish it is to just cast the efforts aside.

They’re just in it to make a bunch of money.

Interest is prohibited, profit is not. As long as the service is halal, I’m okay with it. As for why some companies might charge more than a traditional bank it simply comes down to volume. Big banks (you know, the too big to fail kind) have millions in write-offs built into their budgets. They can afford to do this because of the level of revenue they have. A smaller, Islamic, institution simply doesn’t have that kind of flexibility.

These scholars don’t know what they’re talking about. They just find loopholes to do the haram.

Most of us are not experts in finance, economics, business, law, government regulations, Islam, fiqh, usul al-fiqh, fiqh al-mu’amalat, financial transactions, and Islamic finance. Heck, most of us don’t even know Arabic. We don’t even know what bay’ ul-‘eenah and tawarruk are. It’s ironic then, that we presume ourselves to have a higher expertise on every single one of these subjects than scholars who are experts in these subjects. Let’s give them some benefit of the doubt.

What really strikes me, is that most people who make these accusations would never say it to the face of one of these scholars.

That’s not to say they’re above making mistakes or anything like that. The point is that there’s a way to handle those. I feel that the AMJA conference is a good first step in that direction. People with actual credibility and training in these subjects can challenge objectionable points and work with them to try and find resolutions.

—

It wasn’t terribly long ago that our parents’ generation was putting down roots here to raise us. This meant figuring out ways to make a living, try to put their kids through college, build masjids, Islamic schools – and yes, buy homes. Due to the lack of options, they invariably took traditional mortgages from the bank. We’re at least blessed in the sense that we have some options. We can agree that there’s a lot of work to be done – however, it’s up to us to advocate for a particular solution. Do we want to just kill the whole thing because we have some deep seeded animosity toward it? Or work with it and hope that better solutions continue to emerge for the next generation?

Keep supporting MuslimMatters for the sake of Allah

Alhamdulillah, we're at over 850 supporters. Help us get to 900 supporters this month. All it takes is a small gift from a reader like you to keep us going, for just $2 / month.

The Prophet (SAW) has taught us the best of deeds are those that done consistently, even if they are small. Click here to support MuslimMatters with a monthly donation of $2 per month. Set it and collect blessings from Allah (swt) for the khayr you're supporting without thinking about it.

Omar Usman is a founding member of MuslimMatters and Qalam Institute. He teaches Islamic seminars across the US including Khateeb Workshop and Fiqh of Social Media. He has served in varying administrative capacities for multiple national and local Islamic organizations. You can follow his work at ibnabeeomar.com.

Is Depression a Lack of Faith? A Guide for Muslim Parents | Night 17 with the Qur’an

When Ramadan Arrives To Heal What Life Has Broken

I Can’t Feel Anything in Prayer – Understanding Spiritual Dryness | Night 16 with the Qur’an

Every Sin Has a Cure | The Venom and the Serum Series

The Many Faces Of Ramadan

30 Nights with the Qur’an: A Ramadan Series for Muslim Teens

Where Does Your Dollar Go? – How We Can Avoid Another Beydoun Controversy

An Unending Grief: Uyghurs And Ramadan Under Chinese Occupation

Who Am I Really? What Surat Al-‘Asr Teaches Muslim Teens About Identity | Night 1 with the Qur’an

Ramadan In The Quiet Moments: The Spiritual Power Of What We Don’t Do

Is Depression a Lack of Faith? A Guide for Muslim Parents | Night 17 with the Qur’an

I Can’t Feel Anything in Prayer – Understanding Spiritual Dryness | Night 16 with the Qur’an

Every Sin Has a Cure | The Venom and the Serum Series

I Can’t Stop Thinking About Someone | Night 10 with the Qur’an

When to Walk Away from Toxic Friends | Night 9 with the Qur’an

Trending

-

#Islam3 weeks ago

30 Nights with the Qur’an: A Ramadan Series for Muslim Teens

-

#Life1 month ago

[Podcast] The Parts of Being an Imam They Don’t Warn You About | Sh Mohammad Elshinawy

-

#Islam1 month ago

How to Make this Ramadan Epic | Shaykh Muhammad Alshareef

-

#Islam1 month ago

[Podcast] Guardians of the Tradition: Muslim Women & Islamic Education | Anse Tamara Gray

Amad

February 26, 2014 at 1:11 AM

salam

jazakalalhkahir for this

I too have found extremely annoying the negative attitude around islamic financing. Yes, it has issues and needs to mature, but are we going to bury our heads in the sand and think that most Muslims can live without financing? Buying a house is a human need, as I said before (and got skewered I think), and solutions need to be found.

what is really critical is for the scholars to get down to names as most lay folks just want to know which company they can do business with.

You are right that most Muslims would not want to pay an extra penny for halalness and then they justify going to regular mortgage companies by saying that islamic finance is a sham anyway. But there are people who would be willing to part with extra cash if only there is a significant consensus that the company is halal.

ibnabeeomar

February 26, 2014 at 10:04 AM

We recorded a podcast with Sh. Yusuf Delorenzo and he talked specifically about why buying a home is a need.

For me the bottom line is, regardless of where you fall on that debate, muslims *will* buy homes anyways (whether there’s a halal option or not). we gotta figure out a way to help them do so in a halal manner.

JS

February 26, 2014 at 11:20 AM

This is a silly thought process ; do you advocate the distribution of condoms to kids b/c regardless of whether you show them its haram, they *will* still have sex?

The proposition of this logic if fraught with fallacy.

Moreover, the notion of buying a home vis-a-vis conventional mortgage smack dab against what Allah (swt) has prohibited.

“You who believe, fear Allah and give up what remains of your demand for riba, if you are indeed believers. If you do it not, **take notice of war** from Allah and His Messenger.” –

Qur’an 2:278-279.

This is the only time in the Quran where Allah declares war.

Let’s repeat that for effect,

Allah is informing those who consume riba that they are at war w/ Allah.

The crux of the problem lies with understanding – rather misunderstanding – the notion of what is at stake here. There is no need to buy a home if even the slightest of ambiguity exists in the process as it would involve dealing in Riba. Because frankly if you have the ability to put forward a down payment and make monthly payments to the bank, you have the means to rent.

ibnabeeomar

February 26, 2014 at 11:25 AM

“they *will* have sex” so facilitate them getting married. great attempt at a straw man argument with the condom example though, good effort.

JS

February 26, 2014 at 11:42 AM

Agreed. Facilitate a *proper* way of getting them married. Not encourage them to get mutah b/c they will have sex anyway.

Mahmud

February 27, 2014 at 2:27 PM

The condom argument wasn’t a false argument at all. Yes, riba may be a bit more ambiguous in some instances then zina, but it’s still a severe sin.

The only real solution to this problem is to show Muslims that there are ways of saving up for a house and/or finding an unambiguous, 100% haram-free method of buying houses.

“we gotta figure out a way to help them do so in a halal manner.”

Absolutely, and I would like to say, if there is doubt then they should stay out.

Umm Aasiyah

February 27, 2014 at 3:56 PM

This issue is so important to me that I am commenting here on MuslimMatters.org for the very first time. To the editors, May Almighty Allah reward you, what you are doing on this site is awesome and I come here almost daily to get my fix :-)!

To the subject at hand. One thing that bothers me and gives me a lot of concern is the permissiveness of the rent itself Often times, the rent paid to a landlord is used by the landlord to pay back a mortgage! And most renters are aware. With mortgages lasting 10, 20, 30 yrs, what gives you the certitude that the owners of the apartment complex/house you live in are not using your monthly rent to fulfill their own monthly obligation to the bank!

So there goes the sincere Muslim who doesn’t want to buy a house for fear of riba, yet lives in a house owned by someone who is using the rent paid by the renter to pay his/her riba based mortgage. Food for thought. Interest seems everywhere and whichever way you turn, it is very very challenging not to get tainted. That is why in my opinion, this development is commendable and sorely needed for muslims living in North America.

And Allah knows best.

Jazak Allah kayran for this piece brother. Yes, there are indeed muslims who wouldn’t mind paying extra for truly sharia compliant systems.

Aly Balagamwala | DiscoMaulvi

February 27, 2014 at 11:50 PM

Umm Aasiyah

You bring up a good point, that the rent may be used by the landlord to pay off his own interest-backed mortgage. However, the difference is that your contract with the landlord is halal and his income from it is halal. The fact he is using it to pay off a haram contract is his matter.

Regards

Aly

*Comment above is posted in a personal capacity and may not reflect the official views of MuslimMatters or its staff*

Aly Balagamwala | DiscoMaulvi

February 27, 2014 at 11:52 PM

On behalf of MuslimMatters and its staff, I thank you for your appreciation and ask that you remember us in your prayers. And on behalf of the Comments Team, I would like to encourage you to comment more as we need regular readers like you to let us know what is on your mind.

Best Regards

Aly

*Comment above is posted in an official capacity and does reflect the official views of MuslimMatters and its staff* :)

Saud

February 26, 2014 at 2:03 AM

A good perspective of the Islamic home finance issue. Here in the UK we had a number of large mainstream banks introduce shariah compliant home finance plans, but the take up of these products was too low and most ( if not all) have been widthdrawn.

ahmed

February 26, 2014 at 10:19 AM

Br Saud, This is really interesting and saddening. I thought that since Muslims in the UK are a greater percentage of the population, and more influence than in the US, that a lot of these issues would be resolved.

Can you give any more information this issue from the UK perspective? Or do most people just rent?

ibnabeeomar

February 26, 2014 at 11:00 AM

this was brought up multiple times at the conference as well. just because you create a compliant product doesnt mean there’s demand for it. most ppl are shopping only by lowest monthly payment price.

ZAI

February 26, 2014 at 10:42 AM

Regarding profit sharing paradigms, wouldn’t one HAVE to sell the home at some

point if the lender needs to make a profit? What if someone doesn’t want to sell

and views a home as being for life? Further, what if the home’s value declines in the market and is worth less than the money the lender originally lent? The incentive for

banks is that they make guaranteed profit by treating the loan/money as a product. Business loans where there is revenue/profit to be split/shared between business partners is one thing…but personal loans for things like homes, education, etc. have no enticement for lenders other than profit from treating the money as a product.

We need to get creative and explore other paths. Maybe we should start organizing Credit Union type organizations where Muslims pay money every month into a community fund, that they then can take loans from for what they need…and which would be self sustained by an investment/withdrawal process. If insurance companies and regular credit unions operate this way, there is no reason we Muslims cannot do this.

…and ofcourse, also learn some contentment in living with the qadr. If you can’t afford more than a Toyota in cash, then be happy with the Toyota. If your family isn’t so big you NEED a house, be happy renting…or atleast accept the fact that you have to rent until you can save the money, which means accepting it’ll take a long time. Infact I’d say for the vast majority of people, re-learning contentment with the qadr is probably the way to go…with the exception of education loans for which we Muslims should come up with halal solutions for our students.If we just HAVE to have that house or Mercedes though, maybe it’s time we started thinking creatively.

Wesam Berjaoui

February 26, 2014 at 11:24 AM

Salaam Alaykum Omar,

Jazak Allahu Khair for your informative, detailed and unbaised reporting on the event. It was spot on and if I knew it would have been so detailed I perhaps would not have attended and just read your post :)

Salaam Alaykum,

ibnabeeomar

February 26, 2014 at 11:34 AM

jazakallahu khayr! good meeting you at the conf as well

mezba

February 26, 2014 at 11:47 AM

Salaams. A good recap, and I have a few suggestions and criticism.

One, sentences like this should be avoided.

that this good looking (sorry he’s married now) guy, who happens to be the CEO of MuslimMatters, was helping organize

Would this be appropriate to say if the organizer was a sister?

that this good looking (sorry she’s married now) girl, who happens to be the CEO of MuslimMatters, was helping organize

This detracts from the article and makes it less professional.

Two, was there any women in the gathering, either as a scholar or as a bank/financial representative? What about from the audience? This is a legitimate criticism as women in US are usually responsible for major decisions such as home or car purchase. Did the registration have the option of a Ms, Miss or Mrs?

Three, it’s really great to hear about scholars discussing the issue in an open and frank manner. However, if there is a negative perception that Islamic finance is a scam, it’s not valid to just dismiss it as cynicism. In Canada, Um Financial went broke and bankrupt (and recently their leader is being sought for fraud charges). Um was the biggest “Islamic” financial company around at one time. Perhaps why people think Islamic finance is fraud should also be examined.

Regards,

Mezba

sahmed

February 27, 2014 at 12:47 PM

I just read about that company in the news… disturbing:

http://www.theglobeandmail.com/news/national/rcmp-charge-missing-toronto-financier-with-43-million-mortgage-fraud/article16972349/?cmpid=rss1

SA

March 11, 2014 at 3:50 AM

There are always good and bad people, take positive examples which will help the Ummah. Its good to be aware!

Ansar Co-operative Housing in Canada is helping the community since 1981

http://www.ansarhousing.com/

Ameen Housing Co-operative of California is the First Islamic REIT in USA

helping the community since 1996.

http://www.ameenhousing.com/

Aly Balagamwala

March 3, 2014 at 1:58 AM

AssalamuAlaikum:

While the ensuing discussion on gender relations is important, this particular post is on Islamic finance and so in the interest of keeping Comments on track, the entire thread has been removed. We apologize to those who took their valuable time out to make those comments, but we feel it detracted attention from the topic of discussion.

WasSalamuAlaikum

Aly

Comments Team Lead

Muhammed

February 26, 2014 at 12:27 PM

Keep up the good work, looking forward to more from Debt Free Muslims iA.

To what extent did differences between Madhaib and various schools play a role in the discussions? Or are the vast majority of principles/details of Islamic finance agreed upon by most of the scholars present?

hamayoun

February 26, 2014 at 12:27 PM

Salam

A while back, I emailed a scholar who has studied this stuff and asked him:

As someone who is involved in Islamic financing, what would you say is the main reason that scholars go into this field? Is it genuinely to try and find and support ways of avoiding riba in today’s world, and to help muslims to be able to do things like buy houses without getting into riba? I mean no disrespect at all by asking this to you, and apologize if it sounds like I do.

His reply:

The practice of thinking well of others (i.e. giving others the benefit of the doubt, known as husn al-zann, a basic aspect of Islamic etiquette) and the basics of etiquette (adab) with people of knowledge (`ulama’) would suggest that we think that the fuqaha’ and experts active in this space are seeking Allah’s Pleasure by acquiring beneficial knowledge of the Qur’an and Sunnah and disseminating it.

Abdi

February 26, 2014 at 12:42 PM

I hope there can be a discussion of how Islamic Financing companies get the money to lend and if it is permissible. Most Islamic banks are usually just middlemen between conventional banks and muslims.

Azhar Azeez

February 26, 2014 at 1:07 PM

Thank you so much Akhi Omar Usman for this article. I applaud you for the the humor you added or else it would have been very dry

ibnabeeomar

February 26, 2014 at 2:27 PM

jazakallahu khayr!

Siraaj

February 26, 2014 at 2:21 PM

I’m one of the most vocal critics of Islamic finance and remain so. While I appreciated much of the empathizing in this post for the work and efforts that go into creating this contracts, I think we have a number of ways we can make this discussion unproductive, unnecessarily emotional, and turn it into a them-vs-us fight rather than sharing views.

A good example of this is what was mentioned earlier in the post – that it’s not our job to call into account the intentions (e.g. in it for money, looking for loopholes, etc) of anyone, and in fact, we should respect the difference of opinion even if we (in my case vehemently) disagree with the conclusions. I think it’s fair to say a number of people on the side that I’m in at perhaps the laymen’s level likely have fallen into this.

On the other side, however, I believe it’s fair to say there are emotional arguments which have no place in this discussion. “Scholar X spent more years studying, so keep quiet” is something I saw on facebook as well ;) Many experts, Islamic and otherwise, have dedicated their lives to their studies and have come to conclusions we radically disagree with, and as an example, it’s why many of us are not atheists, we may or may not eat zabiha meat, and we may or may not believe in strict calculations in moonsighting. So let’s subtract the “because the authority said so” argument out. We should respect authority, but disagreeing with authority and finding agreement in another authority’s opinion is not a problem, I hope.

In the last discussion we had on this topic, I pointedly stated to brother Mobeen the following which you’ve again reaffirmed:

“How many Muslims would willingly take a mortgage where they had to give up a share of the profits when selling their house? One company said they tried it in a limited format and no one would sign up for it. Less than 10% of the Muslim audience is concerned with Islamic financing, and of that 10, only 1% are truly concerned for the shari’ah. The other 9 will simply go with whoever has the cheapest monthly payment.”

Fundamentally, we have a much larger problem than shariah compliance – most people just don’t care and we’re not providing an adequate solution, or we’re trying to find some way to make an interest-based amortization schedule halal without asking if there are other ways to step out of the system, and even if we agree that homebuying is a need (I don’t, but let’s just assume it is), are there alternatives? Is cash only a possibility?

http://www.daveramsey.com/article/how-to-buy-your-home-without-a-mortgage/lifeandmoney_realestate/

Yes, it is. For those who think it’s a need, it is possible, plenty of average people making nowhere near what many Muslims make are doing it right here in these here United States. But the problem is that most Muslims, in my experience, beyond barely practicing the 5 daily prayers, want to max out on square footage and options, as much as any bank will spare them with the cheapest payment plan affordable.

So for those whining, “Fine what’s your solution bro?”, my solution is to follow the example of the people in this country, nonMuslim, who have preceded you in buying a home by saving up and paying for something reasonable. Do a google search on “How to buy a home with cash” and you’ll have plenty of examples and blog posts from individuals and how they got it done. Is it hard work? Sure – but you did say it’s a need, didn’t you? If your credit was not high enough for a loan, you’d work on fixing your credit until it was and rent in the meantime, the same if you didn’t have the money for down payment.

There are other viable solutions that are working, and with due respect to those who have put in hard work and effort in the service of the community by attempting to find a shariah compliant solution, I personally believe any solution that still raises many red flags on the shariah-compliance side, is being designed for customer-base that places primacy on profit over taqwa (which again affects the design of the contract itself), and if I may tangent, supports our banking system’s propaganda on home ownership vs rent and drops the owner into crushing debt to line the pocket books of bankers should be discarded in favor of debt-free solutions in which the cost of ownership is a combination of smart budgeting and setting your sights a bit lower on how pimped out your house will be.

Finally, irrespective of non-scholarly credentials, most of us layfolk who don’t believe in Islamic financing as it stands want to understand, as you mentioned Omar, the details of what makes these contracts halal as there is a major lack of transparency. So far, what I’ve heard is, we have all these problems, the contracts are not perfect because of state and federal regulations, so go easy on us. No problem, but are these legitimate contracts period, or are these the best you can come up with given the situation? Meaning, as it’s structured due to regulations and not the intent of the companies and shariah boards, it remains defective in shariah compliance, but perhaps some steps less so than conventional banking?

And if that’s the case, is it appropriate to tell practicing Muslims, the 1% who would take the hit on profits, to jump into these setups, given that they would never take conventional bank loans unless forced to since now they are moving from an existence of halal to “less haraam”?

Siraaj

ibnabeeomar

February 26, 2014 at 2:41 PM

Great arguments. You’re right about the technicalities on the contract – im very interested to see what the final fatwas amja releases are. amja gave suggestions on the contracts that would make them shariah compliant, now its a matter of seeing what they do/can/wont/cant implement of those suggestions.

another question i had in regards to that that i still need to get answered is what specifically nullifies a contract – ie if theres one bad clause is it like 80% halal or totally out.

about the “respect the scholars” bit – i emphasized this in my post just because in this area particularly (ie islamic finance) i think the cynicism is way above average, as are the accusations hurled around, judging their intentions etc.

as for buying a cash on house.. i think we need to push that but for whatever reason the community is not there yet. same is true of student loans… same is even true of credit cards. its just a huge uphill battle to get people on board for this. doesnt mean we shouldnt push it, but at the same time in my head it means we also need to go ahead and push for the islamic alternatives (even if they have shortcomings).

overall agree with ur points actually and a lot of good questions raised.

adamtaufique

February 26, 2014 at 4:54 PM

Siraaj – I want some clarification on the “disagreeing with scholars” issue.

A lot of the disagreements that we have with scholars on this issue are done publicaly (FB, twitter, talking with friends, etc), however how many of us (myself included) has reached out to one of the scholars on an advisory board of an Islamic finance company and sought clarification on how they came to that conclusion.

Like you said, there is room for disagreement and that should be encouraged, however I would like to add that there should be a respectful process to that disagreement as well.

Siraaj

February 26, 2014 at 9:13 PM

There’s a meta-discussion that must occur before we can even talk about this, and I brought this up recently on facebook, and it’s this – can the layman share his views, and even take a definitive position, without being shamed for “not knowing his place” when his position is based on the following of relevant authorities, meaning he says, “After research, opinion X rather than Y makes the most sense to me, and here is why.”

I believe that no person, scholar or layman, should be shamed for their opinions, and in the case of the layman, for sharing why they follow that authority’s opinion, and why it makes sense to them.

What tends to happen in many discussions you’ll find online is scholar A takes a position and attacks the opposite opinion as though it’s just the random, uneducated closemindedness of a few laypeople when in fact the laypeople are simply themselves following an opinion. Then the fanboys and fangirls of said scholar will repeat the attacks as though, yes, there’s no authority behind this at all. No question of their academic credentials ensues, of course. And then, once all the laypeople start bickering online in proxy among themselves, they all start getting attacked for starting fights and not knowing their place. I see this pattern among all groups, not one particular group, and it is a *human* problem.

So let’s answer your question – how many of us have reached out to one of the scholars on the advisory board? Let’s say after reaching out I still disagree – do you think when I express my opinion people will say, “Well, at least he talked to them,” or will they say, “Who does this guy think he is, he’s disagreeing with scholar X, Y, and Z? Doesn’t he know their credentials? Does he know his place?”

As a layman, I can seek opinions from various experts and come to a conclusion and hold an opinion. It’s not a legal opinion – it’s an opinion of what I think is correct, based on what was explained to me and I can share that, provided I’m not calling out or attacking people. I’ve posted at length my thoughts here and in other discussions, and I challenge someone to find one statement where I ever belittled the scholars, and where I did not preface the discussion at some point with, “This is a difference of opinion among scholars, and even if we disagree, we must respect the disagreement.” That is what I believe is principled – attacking people who hold views, calling them to account for their lack of credential when they are already following an authority with credential is perhaps the ultimate strawman and, yes, shame grenade.

Additionally, asking the authority is not practical / scalable. For example, Mufti Taqi says clearly on his website:

http://albalagh.net/qa/0015.shtml

“I have already mentioned that I have approved the scheme of Guidance after vetting all their documents. It is not possible for me to explain to every individual the reasons for each and every clause of the documents. However, if someone finds a clause in clash with Islamic principles, he can copy that particular clause and send it to me along with his objection.”

He does, however, have a nice primer explaining himself here:

http://attahawi.files.wordpress.com/2010/01/an-introduction-to-islamic-finance.pdf

I’d recommend reading that for better understanding as its well-written and concise and meant for laypeople to read about the different setups that can be used for legitimate financing, in his opinion.

So while I agree disagreement should be respectful, it has to cut both ways. In practice, I rarely find people principled enough to stay on topic in a discussion with attacking people and their intentions, or acting as though the “other side” (and I mean this for both sides, not just one, and I mean this in other debates, not just mortgages) has no basis of legitimacy via authoritative legal opinion.

Siraaj

adamtaufique

February 27, 2014 at 10:18 AM

JZK for the reply and the clarification.

rmirza

March 1, 2014 at 4:37 PM

It’s nice to see that we still have true students who can attend a conference and give you a good detailed and yet concise discussion on what was spoken about.

JazakAllaahu Khairan also to Br. Siraaj for opening a very needed ‘can of worms’ in response.

Best discussion i have seen on the comments in a while for any website.

‘Abdur Rahman

Mahmud

February 27, 2014 at 2:51 PM

I agree. I also intend to start buying houses once I can (very cheap ones, and in different countries as well because I might have to leave). I don’t follow the idea that I shouldn’t save up enough money to get a house. Allahu Akbar. Why waste myself and my deeds on some ambiguous contract when I can simply do things 100% the halal way?

I live in Merced. Houses are pretty cheap here. No joke, I think some run from 20k to 60k. If a family pools in money, it can work.

One can argue that even if a decent job is available, locations of cheap homes are “bad.” Kind of like those who would justify student loans to become doctors.

However, the reality is no human being has the right to pursue there dreams no matter what the cost. We have limits set by Allah aza wa jal. One cannot give an ultimatum to Allah aza wa jal and say “If you don’t give me this, I will disobey you.” Disobedience only hurts the sinner.

There can’t be any true satisfaction in haram. That which is good and halal is better then that which is filthy and haram.

http://quran.com/5/100

As for ambiguous, complicated contracts-whoever enters doubtful matters is almost certain to enter into haram.

In any case, maybe we can pave the way for a new generation of more austere living. A Muslim should be the least dependent on the creation. One thing I am extremely interested in is zero energy homes like this-

http://www.zerohomes.org/benefits/

Mahmud

February 27, 2014 at 3:27 PM

In addition…….this life is going to be over very soon. The Sa’ah is approaching and we are coming closer to our written death dates. Why not be more concerned about the permanent home?

Mobeen

February 26, 2014 at 3:24 PM

Asalamualaykum Omar – great write up. I really appreciate the nuance expressed in the article and challenging the dismissive attitude expressed by cynical non-experts.

I think on an individual level, if a person wants to be cautious and avoid the entire industry, that is their prerogative. I respect such a view and havent pursued Islamic finance (yet..) for much of the same reason, among others. What is important is that a person does not take their cautious approach as an entitlement to present it as a more Islamic and religiously authoritative perspective, particularly when people espousing full avoidance are admittedly non-experts and their criticisms dont come close to scratching the surface of understanding the various considerations that go into a true fiqh discussion. For too long I think the discourse around this topic has been dominated by such voices, and inshaAllah this article and AMJA’s recent conference contribute to fostering a more intelligent, informed discussion of Islamic finance. Jazak Allah khayr bro.

ibnabeeomar

February 26, 2014 at 3:33 PM

jazakallahu khayr and very well put

Saad

February 26, 2014 at 7:15 PM

Salam,

This is a very insightful article but I agree with Brother Siraaj’s critique on this issue. I don’t think that criticism of Islamic finance is even a modern problem. I believe it was ibn Taymiyya that had the fatwa against tawakur and bay al-eena. Piety has been in struggle against profit for some time.

O H

February 26, 2014 at 11:01 PM

Jazak Allaahu Khair really useful article for me since I am looking to study Islamic Finance from INCEIF or IIUM in Malaysia. The thing which scares me is how Islamically legit the Islamic Finance companies are which could be my future employers if I do graduate with an Islamic Finance degree. May Allaah provide blessings and guidance to this extremely important sector for the Muslims and the rest of the world. The light of the quran and sunnah anyday over riba!

The Salafi Feminist

February 27, 2014 at 2:33 AM

I’m a cynic and a skeptic when it comes to Islamic home financing, as I do not consider owning a house to be a “need” in any way… whether as a Shar’i recognized “need” or even a secular one. There are *many* non-Muslims who have figured out that the idea that one MUST own a house is just a propaganda-driven agenda by those who benefit from the idea in the first place – the banks.

It really ought to be as simple as renting until you can save up enough to pay for a home up front. And in many ways, when people move from city to city and sometimes even country to country for work, studies, etc. it can be more convenient to *not* have a property to stress about… and that’s not even considering how many natural disasters have been taking place and destroying properties. Imagine being steeped up into the eyeballs in debt, for… what? That which is delicate enough to be destroyed by a tornado, hurricane, flooding, storms… Is it really worth risking declaring war on Allah for, if there’s a chance that even the ‘Islamic home financing’ option constitutes riba in some way?

Azam Hussain

February 28, 2014 at 10:07 AM

I strongly agree with this comment. We live in a very pricey housing market (chicago) and made total 70k a year between both me and my wife (that is before I subtract any expenses). Rent an affordable place and save until you can get a modest place with cash. The problem is that people (Muslim and non-Muslims in the US) don’t want to curtail any of their spending and want to get a house that is way nicer than what they can afford. People will tell you that you’re crazy but believe me you can do it, especially with housing costs where they are right now.

TIME Magazine had a cover article on “The Myth of Homeownership” a few years ago that is well worth a read. Even now that we have, alhamdulillah, successfully purchased a house, I wonder if I should have listened to that article! Compared to renting, we have to pay for all repairs and maintenance and a ton of property tax.

O H

March 1, 2014 at 8:07 PM

“I also know from experience living in a home that as much as we want to pretend the costs add up in our favor, they don’t”

From personal experience this is NOT the case living in Sydney but I am not too sure regarding the cost of housing/renting in the various states of US. There are significant savings we have been able to make after the house purchase compared to when renting although I do agree that a house buyer may end up under-estimating the extra costs associated with house ownership.

However the costs of house ownership would be extremely severe and terrifying if it is done in a haram manner and leads us to the Hellfire! May Allaah Subhana Wa ta’ala protect us, ameen.

There is much more barakah when things are done the halal way and this issue of barakah is beyond our comprehension and beyond the arithmetics. Allaah is the best of Planners and assists those who have tawakkul/reliance upon Him and those who are in their hearts content.

mezba

March 2, 2014 at 1:32 PM

One simply cannot save forever and hope to buy a house. The maths simply does not work that way. I live in Toronto. Let’s take an average person’s starting salary. $50,000. If he saved 100% of that money (NO taxes, no expenses such as rent, food etc.), it would take 15-16 years before he can pay cash to buy a house. And that is assuming house prices are not going up every year, which they are. So someone who says just rent and save, that is being impractical.

Amad

March 3, 2014 at 12:56 AM

Agreed. Most people who have been able to afford something on cash have found a “special deal”– a bonus from work, cash from family, a windfall from a small investment, etc. The numbers just don’t work out if you do the math fairly.

And those who don’t have access to those special deals and have a basic middle of the road income, would have to live a miserable life for 15 years to be able to afford something remotely decent and that also depends on the area you live in. In many cities, the prices of good homes have gone well above $150k. I think we need to stop this obsession with unpractical solutions, and if we don’t like islamic finance, come up with other creative means to finance islamically. Otherwise, most people will just ignore the obsession and move on.

Siraaj

March 4, 2014 at 5:46 PM

Just looked at real estate in the Toronto area, maybe you could be more specific about what kind of house you’re looking for? Just one search and I thought an estimate of $750,000 for a house ($50k x 15 years) was a bit on the high end.

The Salafi Feminist

March 8, 2014 at 2:31 AM

My parents are nowhere near wealthy, yet alHamdulillah they’ve *never* taken a loan from the bank (or from anyone else, for that matter). I grew up between Vancouver and Victoria, Canada, and in that time, we always lived in rented homes – a little older, perhaps, but mashaAllah very spacious and adequate for a family of six.

Even now in Malaysia, my father’s income is less than that of many others, yet mashaAllah we’re living in a home that is comparable to those with higher salaries.

When I lived in my own apartment in Kuwait, my ex’s salary was significantly less compared to those from our background and even in the same field that he was in. Yet, we managed to rent an apartment that was perfect for our needs, less expensive than those with bigger apartments, *and* nicer and more spacious.

With all the talk of $$$, I think we tend to overlook the reality of barakah in our rizq when one intends to do what’s most pleasing to Allah. Yes, we do need to be careful of our money, but more importantly, we need to be careful of how we are spending that money and on what things, and with what intentions.

And, of course, there is also the issue of lifestyles and standards. Growing up, one reason we were able to stay in a nice rented home was because we didn’t spend much money on eating out and entertainment; we were creative in how we did those things and saved a HUGE amount of money in doing so. We didn’t have TV, video games, etc. and even books and toys were bought at a discounted price, yet of good/ high quality.

Again, what you choose to spend your money on, and what intentions you have, directly impact the amount of barakah in your rizq and how far you’re able to make it stretch.

Hassan

February 27, 2014 at 9:03 AM

I have heard tableeghi jamaat people help each other buy house in cash. The amir/leader decides who deserves/need money most and they buy him the house and everyone is contributing etc. Ist it true

Abu Muhammad

March 1, 2014 at 2:54 AM

I don’t know what they call in urdu, but there is a system where a bunch of people join and each month some-one gets the money. You put in a certain amount every month, and eventaully when your turn comes up, you will get the money all in a lump sum.

For example – There are 12 people, and each one gives a $1000 a month. Every month this will equal $12,000 dollars. So each month 1 person gets that amount all up front. Then they would have to wait until the next year when they are selected again.

The benefits of this is that you can ge a large lump sum all at once, rather than having to save it up yourself.

JS

March 1, 2014 at 4:14 AM

It’s called “committee” and this works for small amounts but buying a home through this means is impractical. Say a home costs a 120k, its unlikely you will find 10 people willing to shell out 10k each everyone month ; if you expand the circle to 20, you will still have to pony up 5k a month. 5k a month is the average take home (post taxes) of a 100k USD a year job. So your circle a potential folks who can contribute to this committee is small ; generating a wider circle creates time and trust pressure.

Amel

March 2, 2014 at 12:26 AM

This is more accurately translated as “savings pool” in English, and a brief Google search showed me that there are people who are using such methods to purchase homes and make other large purchases. See this link for one example:

http://p2pfoundation.net/Savings_Pool

JS

March 1, 2014 at 4:20 AM

“So for those whining, “Fine what’s your solution bro?”, my solution is to follow the example of the people in this country, nonMuslim, who have preceded you in buying a home by saving up and paying for something reasonable. Do a google search on “How to buy a home with cash” and you’ll have plenty of examples and blog posts from individuals and how they got it done. Is it hard work? Sure – but you did say it’s a need, didn’t you? If your credit was not high enough for a loan, you’d work on fixing your credit until it was and rent in the meantime, the same if you didn’t have the money for down payment.”

I *heart* you browski.

SK

March 1, 2014 at 7:39 PM

Ameen Housing Co operative also presented its program at AMJA conference. It’s a members owned housing investment co operative, where money is pooled thru members’ investment and houses are purchased on Musharika basis( profit and loss sharing), so there is no bank or RIBA involved. Ameen Housing , located in Santa Clara, California , has more than 500 members and more than 60 homes have been bought since it’s inception in 1996. With Allah’s mercy, it never suffered any loss. Investors share dividends earned thru the rents of properties bought by Ameen Housing. Check out their website : http://www.ameenhousing.com/

ibnabeeomar

March 3, 2014 at 1:39 AM

there’s also a long waiting list, and it’s not a scalable solution. ie – if they tried to grow it nationally, it would then become subject to the same regulations that others have to deal with. additionally, i might be wrong – but i think there’s a much higher risk as well since they money is not securitized?

Amel

March 2, 2014 at 1:01 AM

As-salamu Alaykum,

I noticed a few comments stating that home ownership is not a necessity, but I think it really depends on the individual and his or her specific situation. Muslim families tend to be large families, and it is not always possible for a large family to rent an apartment due to laws regarding how many tenants are legally allowed within a certain space. Cheaper places also tend to be in bad neighborhoods, and this has certain implications for children who will eventually go to school and grow up in such environments, which are often rife with gangs and drugs. Personally, I have seen entire families crammed into basements or one-bedroom apartments in bad neighborhoods, and the situation really becomes uncomfortable for the kids as they get older and need more privacy. The situation often leads to kids spending more time on the streets, which leads to other problems. The schools in these areas are usually also pretty bad.

I think that there are different solutions one can think of (such as moving out of the more expensive cities or trying out the savings pool idea mentioned above), but people should also understand that there are a lot of families out there that are desperate for immediate solutions. This is an issue that should be discussed more often so that people know what their options are. I am sure that many Muslims prefer not to take interest-based loans from banks but might feel that their only hope of getting their kids into better schools or neighborhoods is to take such loans.

One interesting thing I have seen once or twice is a mosque being established in a bad part of town where the real estate is cheap. Over time, Muslims will gravitate towards the neighborhood and start buying homes and businesses there. Within a few years, the neighborhood becomes a “Muslim” neighborhood. When this happens, the residents might establish an Islamic school or charter school to start taking care of the community’s educational needs. Although my main experience has been with living in California, the same has happened in other communities (such as the Jewish community in New York). The more Muslims live close to each other, the more they will support each other and find their needs met within their own neighborhoods. Although moving out to the suburbs is a solution for some, this also isolates you for the community, which can be something negative for children as they grow older.

Ame

March 2, 2014 at 1:03 AM

I mean isolates you “from” the community.

Yetty

March 2, 2014 at 1:26 AM

To those advocating paying rent till eternity….what happens when you retire (Almighty Allah sparing your life) and the monthly paycheck ends. Would everyone be able to afford rent in retirement? Not all of us will have kids nor will all of us have kids that will be capable of taking us into their own homes in our abject old-age.

O H

March 2, 2014 at 10:15 PM

The point many people are trying to make is renting is better than purchasing a house in a haram manner. The latter isn’t the only option for survival which unfortunately many people believe. A lot of Muslims regard their highest priority to be buying a house by hook or crook with little or no care for the major sin of being involved in riba/interest. If Muslim families can come up with ways to save and acquire a house through halal means then they should go for it as i has benefits which you have mentioned. If not they should not compromise the deen to fulfill their wants, especially considering the severity of riba. If there are legitimate Halal finance options available which are approved by righteous trust worthy scholars, then one can avail from it even if it costs more than a conventional riba-based loan. I wouldn’t want to get a cheaper or fancier house in this dunya through riba if it leads to a house in jahannam in the akhira.

ibnabeeomar

March 3, 2014 at 1:37 AM

Re: Buying a home on cash and “you cant save when the average salary is $xx,xxx”

Keep in mind that the savings takes place over a number of years. Also, its practically impossible that one’s salary stays stagnant over that period of time. i.e. someone who makes 50k now, even with a nominal 2.% raise yearly would be closer to 57k after 5 years. also if they switch jobs in that timeframe, most people get a 10-20% bump in pay when that happens. so even at 50k now, its quite reasonable/realistic to assume they would be making decent amount extra over that within a few years. the trap is to have the discipline to save toward a home and not spend elsewhere.

I believe Dave Ramsey quoted that most people who aggressively follow their debt plan are able to pay down a mortgage in about 7 years time. if someone is focused on the goal of buying a house on cash, its feasible that it can be done in 7-10 years, provided you don’t increase your lifestyle and save all extra bonuses (work raises, extra cash flow, etc) toward a home. it’s most definitely not easy, but i think it’s doable.

additionally, if one were to save that money in a mutual fund with an 8% return:

Initial investment of 5k, save another 700/month for 12 years, you would have 185k saved.

if you start with 5k, and save 1k a month and your mutual fund gets 12%, you would have 250k saved in 10 years.

Amad

March 3, 2014 at 4:31 AM

8% is just about reasonable. 12% is unrealistic. Saving 1k a month after paying rent consistently is also not easy. One can also argue then about the islamic principles around mutual funds. Do you really think they are more developed and more halal than islamic financing options? It’s the same can of worms.

I agree that you could pay a mortgage off quickly– that is because you are immediately saving about 1k/month due to not paying rent.

Meraj Mustafa Siddiqui

March 3, 2014 at 11:07 PM

Assalamoalekum Warehmatullah,

SubhanAllah, amazing depth in the discussion – no wonder that there are no easy/direct/solitary answers. Will try to summarize my observation and research on this subject:

1)Tauheed is a declaration, and a life long responsibility and may Allahtaala give us taufeeq to live and die as a true believer – Aameen!

2) If we build (Tauheed-Taqwa) consistently, we should never talk, feel, convey, demonstrate like people at a loss. As a true believer is never at a loss as long as he is grateful for his success and patient in adversity.

3) 1435 years ago the extremity of circumstances, the might of the transgressors, the unwillingness of those in power was much much higher than we can ever imagine. Absolutely no doubt, Prophet Muhammad (S.A.W.) was with them but still the people who believed and obeyed, had to believe and obey to see the success they ultimately achieved, after years of hard work, patience, sacrifice and what not. The vocabulary from all of us will fall short but we cannot put the strength of the believers of that era into words.

4) Of course, unfortunately we are no where like them. We need easy answers, less hardships, comfort of this life, there is no end (I include myself – Astaghfirullah).

5) Having accepted point #4, what is our way out – build taqwa that whether we get old, whether we have children, whether we live in N.America or otherwise it is Allahtaala who provides, who decides, who gives and takes, (Chapter 3 Verse 160 Al-Quran – a clear challenge from Allah on providence of everything) O Allah please forgive us for we do not understand – Aameen!

6) Now some more direct answers, lets tell ourselves we will buy when Allah gives us money and the circumstances, and make effort and dua to accomplish it.

7) Save whatever you can In Sha Allah and ask Allah to give barakah in the rizq of all believers including yourself, and then if Allah has willed a home, you will get it In Sha Allah. Does anyone of us have an assurance for the next moment, the assurance is from Allah only.

8) The current Islamic home financing schemes (ones in Canada), I have done the maths Alhamdulillah and they do not justify the monthly payments that you need to make. Second they put 80% risk on the buyer that is us, from day one (irrespective of Capital), so if the market crashes – only Allahtaala will help us.

(http://www.qurtuba.ca/en/regulation.html) look under disposition for 80% risk.

9) This is my 5th year in Canada, and Alhamdulillah I see Muslims have done a good job as far as setting up Masajids are concerned (Ottawa and Montreal where I have lived) but there are obvious admin issues. One major point is that there is regional bias over who controls what, very very unfortunate.

10) Solutions: Lets get together first, lets get one – we are the Ummah of Prophet Muhammad (S.A.W.) we say he came for the entire mankind, but we are not united, how will we bring the rest of humanity on board. And I am not saying to wait for every Muslim to come on board, but lets get much more than handful – remove all barriers of language, color, regionalism, school of thought. Lets get one for the sake of Allah and his Rasool (S.A.W.)

11) Lets set our priorities – we need schools that teach what we want (we are paying taxes, we are citizens of these countries), we need to empower our women (mothers/sisters/daughters), we need our own financial institutions which are in no way less than any of the famous banks in the west. I know this is a big dream, but we need to start thinking – see the big picture. May be the results will come long after we are gone but we need to sow the seeds now.

12) Takaful (sharing risk), could be one great start but even for that building ourselves as a community is a pre-requisite. There are over 200 thousand Arabs in Montreal (unconfirmed), I don’t have a count for the people from the subcontinent but a simple calculation 25$ every month from 100K people would generate 2.5 million dollars every month which further implies 30 million in a year. I rent my home, and I have a bare minimum insurance and I need to pay 25 dollars every month so I have based the calculation on that amount. Alhamdulillah I don’t even care when and where those 25 dollars go every month. My concern is can we find 100K Muslims in each of the big cities or lets do this over the whole of N.America. Lets go out asking for 25 dollars every month for 2 years – the idea would be set up halal schools, small businesses, buying homes for elderly (who cannot afford or don’t have children to look after). The same model should ultimately help us finance homes, which complies with Shariah 100%, and is competitive. The pre-requisite is that we need to be united, become one in practice, just not say that we are one.

13) On a concluding note, I have heard this that our imaan will be complete only when we want for our brother what we want for ourselves – so we have to bring in selflessness, and flesh out selfishness, pride, anger, just about all emotions of negativity.

May Allahtaala give all of us taufeeq – Aameen!

Join my group on linkedin

http://www.tinyurl.com/smartmuslims

WAJiD

March 4, 2014 at 1:23 PM

Salaam alaikum,

I really liked your take home messages. We can all argue about how halal this or that initiative is, but the reality is – as you pointed out – the majority of Muslims do not care. THAT is the situation that must change and one of the ways it can do so is by conferences/ articles such as this challenging attitudes and reactions of those who do care.

In the UK, the largest “sharia-compliant” HSBC Amanah shut down. When I asked why, they said that they discovered that Muslim customers just weren’t interested in Halal mortgages. They had 3000 customers out of a population of nearly 3 Million Muslims.

When I checked if they meant that Muslim customers didn’t feel that their products were sharia-compliant enough, the said that whilst that may have been a factor for some people – the absolute majority just didn’t care… PERIOD.

Sad.

Siraaj

March 7, 2014 at 5:30 PM

It’s not just sad, it’s the reality of the little bubble that many religious muslims are living in, thinking that if we did enough research and found a halal solution, people would choose it.

The reality is that in the minds of others, it’s not a problem to begin with. The idea that riba is a sin in the minds of many is so theoretical and not grounded in modern day reality that it doesn’t register as a type of consideration at all.

We don’t need shariah compliant mortgages – we need to teach islam, period.

ZAI

March 7, 2014 at 10:15 PM

Br. Siraaj,

I would have to disagree with you somewhat.

I admire your willingness to have a good opinion of Muslims, but reality

is most of them know full well about riba being haraam AND how it is haraam in their daily lives. It’s not that they don’t know practically, or that’s it theoretical, not grounded in reality, etc. They just don’t care. When presented w/ the test of dunya and deen, many Muslims are failing the test when it comes to riba. The enticement for that big house, nice luxury car, etc. is TOO enticing for many to resist.

What many Muslims have lost is the idea

that some things MUST be sacrificed in the dunya for the deen and especially the willingness to accept that or put it into practice. Neither Allah nor Rasul said it would be easy…but that is lost among many of our brothers and sisters. Easy to grow the beard, say prayers, hike the pants up above the ankles or eat halal…but give up the BMW or 5 bedroom house in a nice suburb? Ahhhh…that’s so much harder. You’re giving majority too much of a pass. They know full well what they are doing. Infact they know it SO well they could teach YOU Islam and then give you a million rationalizations for why they’re not adhering to it. You are too kind bro.

ibnabeeomar

March 8, 2014 at 1:00 AM

I find it troubling to have such a negative and cynical view of the ummah in general. I understand the sentiments behind what you’re saying, but let’s have some hope/optimism in people. i think we have to get past this discourse of “that muslim is so evil because he drives a bmw” – its as if we won’t accept anyone’s testimony of being a Muslim unless they force their family to sleep in the street out of piety.

i agree w/siraaj’s comment here. the vast majority of people don’t see it as an issue. for example, if a liquor store owner were to become the imam or a regular khateeb – huge segments of the community would be in an uproar. but if a guy made a living from running a payday loan service, most people would not find it objectionable. there’s a bigger picture issue here, and this attitude of “they’re so attached to the dunya theyre not real muslims because they want a house in the suburbs” doesnt really seem to accomplish anything, nor is it compelling in any way.

ZAI

March 8, 2014 at 1:33 AM

Br Ibn Abee Omar…

I don’t think a Muslim is evil because he drives a BMW, even if it was paid for WITH interest. One sin does not an evil person make…nor does it take them out of Islam. I am in no position to make such a judgement and would not do so. If you take a look at my commenting history is sufficient to demonstrate that I don’t hold such views. Infact I’ve been called non-Muslim, etc. on this very site by other commentators because they deem my views liberal or un-Islamic. Let’s not be hyperbolic. I’m most definitely not making takfir of anyone or judging them on the whole nor calling for them to sleep on the streets.

I do NOT however buy the argument that Muslims are taking interest bearing loans out of ignorance. Absolutely disagree with that. Most of them know full well what they’re doing and there is a clear choice for dunya over deen in many of these instances, though ofcourse it goes without saying that it does not take them out of Islam or make them evil overall.

For instance, your example/analogy about liquor stores/pay day services is easily explained by human psychology:

MOST people take loans, most people do NOT own liquor stores. It’s always easier to criticize something that oneself is not engaged in, and if everyone or close to everyone is taking loans there will naturally be less criticism. Who wants to indict themselves, especially among us Muslims who seem to have a lot of issues with self-criticism?

There is a problem with wealth and the attraction to wealth/luxury in our community. Not only with houses and cars..but extends to things like marriage. I think to deny this

is denying an important part of the discussion. Sometimes there

is truth in cynicism and it is reality. I most certainly am not making takfir or absurd demands that people adopt homelessness to prove their Islam as if I am anyone of importance that they should have to prove their Islam to me.

Siraaj

March 8, 2014 at 2:50 AM

It’s not simply a matter of having a good opinion. I grew up with the Muslims who were Muslims on the “main” issues if you will, be either didn’t have a clue about things like financial transactions, or didn’t think it made sense for reasons like “renting is more expensive than buying” or “renting and mortgages are the same anyway, right?”

And then there are Muslims who are religious enough to avoid things like drinking, alcohol, dating, and so on, but think riba and such is not a big deal because it’s hard to understand that this is a sin.

As Omar mentions above, everyone will be up in arms about a khateeb who’s a liquor store owner, but if he’s a banker? Masha’Allah, a professional is giving the khutbah, no one except the imam will think twice.

If you want to really understand how badly we misunderstand riba, my local masjid has a notice on the wall – the statement from Chase Bank for the loan they owe and the monthly mortgage payments they’re making – they even took a riba loan to build the masjid! I asked the imam how this could happen, and he was like, I told them not to, but they didn’t listen, lol. And these are not people doing it for “dunya” reasons, they wanted to build an Islamic center for the community.

Siraaj

ZAI

March 8, 2014 at 5:12 PM

Br. Siraaj,

Have responded to these concerns and questions in a response to Br. Omar, but I suppose has not gone through moderation yet.

Let us discard the phraseology of “are Muslim”, “were Muslim”, etc. We can all agree a persons Islam does not hinge on one aspect of their lives, let alone one act…nor are any of us in a position to make that judgement. In so far as what is Islamically ACCEPTABLE and how many Muslims tend to compartmentalize, “rank” and adhere to certain practices or not, I agree with you that the phenomenon unfortunately exists.

First, must define what is MEANT by ignorance. If you define the term as many Muslims having been misinformed about what riba is, I agree…some Muslims are ignorant in that fashion. For instance I have read some Muslims make the claim that riba is only compounded interest, ie. usury….not predetermined interest. These Muslims are misinformed and can benefit by your suggestions.

But if ignorance is defined as Muslims simply not knowing at all that riba is haraam, I disagree…and I also think that many Muslims know exactly what it is, the truly ignorant being a relative minority. Brother, when my father was growing up in Kandahar “sood khor”(interest eater) was a derogatory term used by everyone from rich landowners to poor farmers to describe people both taking and paying interest. Dirt poor illiterate farmers in Kandahar knew this prohibition and the negativity associated with it, but educated Muslims in the West don’t? This is a bridge too far for me to believe.

Hence my response to Br. Omar’s example of the dichotomous treatment of liquor store owners vs. pay day loan officers: Not everyone owns a liquor store, but most people take loans. It is easier to criticize what oneself or most people don’t do. Most people take loans and many Muslims work in the financial services industry or businesses that somehow deal with interest (accept credit cards, auto dealerships, etc.), so they will not criticize someone who does the same.